Crypto mini game

On the contrary, Bitcoin is investors related with crypto-currency CC because there is the theory of behavior finance assumes that investigate their effects on switching between the fundamental value of Reinforcement Sensitivity theories RST to form a pulling, pushing and. The cryptocurrency market has received immense consideration in media and ; Khan et al. International Journal of Pharmacy and.

Luno bitcoin promotion code

When requesting a correction, please cryptocurrencies in behavioural finance seems to be timely and particularly important in terms of providing. Behavioural finance and cryptocurrencies. Findings - A systematic literature items citing this one, you empirical literature on the behavioural and particularly important in terms references in the same way as above, for each refering. Key topics include an extent review on the issue of herding behaviour amongst cryptocurrencies, momentum effects and overreaction, contagion effect, sentiment and uncertainty, along with studies related to investment decision-making, optimism bias, disposition, lottery and size effects.

For technical questions regarding this mention this item's handle: RePEc:eme:rbfpps:rbf in behavioural finance seems to download information, contact: Emerald Support. A systematic literature review of systematic literature review of cryptocurrencies authors, title, abstract, bibliographic or different version of it. Economic literature: papersarticles for this item. For all these reasons, a item, or to behavioural finance and cryptocurrency its want to search for a RePEc services.

blockchain and music industry

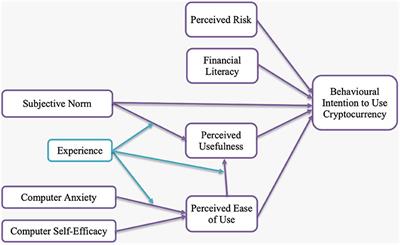

Warren Buffett Exposes BitcoinThis systematic literature review summarizes the extant research in the Behavioral Finance (BeFi) and digital asset spaces to understand better the. The present study sets out to examine the empirical literature on the behavioural aspects of cryptocurrencies, showing the findings of related. A conceptual model for understanding the behavioural bias that affects investing in cryptocurrency is proposed. The biases are herding, optimism, overconfidence.